Correct Pricing When Inflation is on the Rise

How to Correct Pricing When Inflation is on the Rise

Several creative ways to mitigate supply inflation are lying dormant in many organizations, but only a few of them have been fully tapped. With the right approach, organizations can re-build their price-negotiation capability and long-term resilience. This article will explore a few of those methods. The first method focuses on identifying and minimizing price escalation.

Another way to combat rising prices is by ensuring that prices are kept stable. The main cause of inflation is a persistent increase in labor costs. When labor costs go up, consumers have less money to spend. This means fewer people will buy things. Eventually, prices will stabilize. But this doesn’t mean that the government will cut taxes on items that are going up. Some governments are taking measures to minimize the impact of rising energy prices.

A diversified portfolio can help you combat inflation. A mix of equities, TIPs and real estate can help you achieve the desired return. According to Dan Keady, chief financial planning strategist at TIAA, you should stick to diversification and rebalance your portfolio every year. It’s important to make sure that your investments are a match for the economy’s needs.

The other option is to increase the size of your investment portfolio. The size of your portfolio is also important, as higher returns may result in a more profitable future. However, the amount of investment you have should not exceed your income level, as you don’t want to lose all of your money on fees or interest! As long as you’re able to maintain a reasonable income level, you’ll be well on your way to combating inflation.

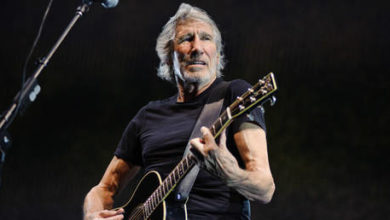

Jonathan Osler explains how the first method is to review your existing prices and compare them to the current ones. If you have a low-priced product, you can lower the price. But if you’re not willing to make adjustments, you should consider other options. This method is more likely to increase your monthly payments. This will be more affordable for your customers. This strategy will help you avoid the risks of rising prices.

According to Osler, if you’re a retailer, your profits will rise when prices are rising. By lowering your prices, you’ll be able to maintain your profit margins. The opposite is true for consumers with lower incomes. Inflation, on the other hand, makes the consumer pay more for their products. Therefore, increasing prices will increase the number of your profits. If you’re a business owner, you can also raise prices.

While lowering prices will reduce overall costs, the rise in inflation can cause higher monthly payments. By keeping your prices in line with your customer’s expectations, you’ll ensure the most effective way to compete in the market. Regardless of your industry, adjusting prices for your products and services should be part of your business model. And as your company grows, it will continue to expand its profits. By adjusting your prices and limiting your costs, you’ll avoid the risks of high inflation.

Although inflation is a natural part of any economy, it is not always desirable. It is crucial to understand the causes of inflation. As a business owner, you need to assess the reasons behind your prices and determine the best course of action for your business. If you’re trying to reduce the cost of your products, you should consider the following options. You may be surprised to find that the cheapest products are the most expensive.

Jonathan Osler believes that it’s vital to understand what causes inflation and how to manage it. Inflation is a general measure of the rate of increase in prices across the board. Inflation is a general term for price increases, and it’s often described as the increase in prices of goods and services. Typically, rising prices cause an increase in interest rates, but they can also make it difficult to pay your bills.